Can Big Pharma Save Big Tech From Strategic Collapse?

The AI Dilemma: No Fuel Left for the Pilgrims

Summary: The AI industry is spending trillions on infrastructure for models that are running out of data to train on. The pharmaceutical industry generates exabytes of it every year. This is the keystone advantage that could save Big Tech from strategic collapse — if pharma can build the architecture to make its data economy work like one.

With a 17-3 lead in the fourth quarter against the Denver Broncos on Sunday, the Philadelphia Eagles were cruising to another win that would keep their undefeated record intact.

Until all of their simmering problems suddenly burst to the surface all at once.

They were completely unable to move the ball on offense. Their run defense was repeatedly gashed. And costly penalties kept on adding up.

Philadelphia wound up giving up 18 unanswered points en route to a 21-17 loss, a collapse that was both stunning, yet somehow not entirely surprising. That’s because even when the Eagles had been piling up wins to start the year, they hardly looked like the team that won last season’s Super Bowl.

“The inconsistency showed up again,” receiver A.J. Brown said. “It’s a lot to learn from today.”

— The Stunning Collapse That’s Exposed the Cracks in the Philadelphia Eagles,Andrew Beaton, The Wall Street Journal, October 6, 2025

In a sign of how insatiable OpenAI’s appetite for compute power is, they announced a partnership Monday morning that would see OpenAI deploy six gigawatts of AMD’s chips over multiple years, starting in the second half of next year. As part of the deal, OpenAI will receive the option to purchase up to 10% of AMD stock if it hits certain milestones.

The news release announcing the deal is breathtakingly unsurprising in the narrative describing the latest, urgent humanity-saving deal-making of Silicon Valley visionaries, the ornamental wave of the hand that we’ve come to expect from an entire industry ecosystem built on a set of broadly shared ideas that are easy to point to, even if no one takes the time to figure out where they come from or whether they are correctly applied.

Something like this:

“We are thrilled to partner with OpenAI to deliver AI compute at massive scale,” said Dr. Lisa Su, chair and CEO, AMD. “This partnership brings the best of AMD and OpenAI together to create a true win-win enabling the world’s most ambitious AI buildout and advancing the entire AI ecosystem.”

“This partnership is a major step in building the compute capacity needed to realize AI’s full potential,” said Sam Altman, co-founder and CEO of OpenAI. “AMD’s leadership in high-performance chips will enable us to accelerate progress and bring the benefits of advanced AI to everyone faster.”

“Building the future of AI requires deep collaboration across every layer of the stack,” said Greg Brockman, co-founder and President of OpenAI. “Working alongside AMD will allow us to scale to deliver AI tools that benefit people everywhere.”

There are good reasons to think that simply throwing more computing power at the current models won’t do it, writes James Mackintosh, that the technology of the future might just stay that way.

“Maybe we do get AGI eventually. But how long will investors stay hopeful? The chips being bought today to fill the data centers will be redundant in four or five years, so need to generate significant revenue quickly. It’s highly unlikely they can be paid for with AGI, so they need either investors to keep on funding heavy losses, or customers to be willing to pay for other AI applications created along the way: video editing, fake digital friends, short online answers to replace search.

It costs too much. Here we get to the problem of the other AI applications. Staff at OpenAI, creator of ChatGPT, just sold shares at a valuation of $500 billion. It is on track to meet its forecast of $13 billion in sales this year, almost all from the chatbot, valuing it at 38 times revenue. That multiple is a little more than dot-com poster child Cisco Systems at the peak of the tech bubble in 2000.

Tech firms are spending hundreds of billions of dollars on advanced chips and data centers, not just to keep pace with a surge in the use of chatbots such as ChatGPT, Gemini and Claude, but to make sure they’re ready to handle a more fundamental and disruptive shift of economic activity from humans to machines, says Bloomberg. The final bill may run into the trillions. The financing is coming from venture capital, debt and, lately, some more unconventional arrangements that “have raised eyebrows on Wall Street.”

As well they should. The technology industry is riding the crest of a magical wave that is about to break. The mythology that surrounds the system has stopped making strategic sense.

Never before has so much money been spent so rapidly on a technology that, for all the eternal sunshine that IT promises, remains theoretical as a big market-making or big profit-making or big economy-making model. “Tech industry executives who privately doubt the most effusive assessments of AI’s revolutionary potential — or at least struggle to see how to monetize it — may feel they have little choice but to keep pace with their rivals’ investments or risk being out-scaled and sidelined in the future AI marketplace,” explain Bloomberg’s Seth Fiegerman and Carmen Reinicke.

In other words, an entire economic system has become a self-licking ice cream cone — the tech industry and all of its humanity-saving potential is locked in a massive and infinitely recursive feedback loop that is “unfixable”, at least in conventional-thinking terms (for more on self-licking ice creams, see Comparing the ‘American Way of War’ with the ‘American Way of Healthcare’ published by Blue Spoon).

The Data Wall: 2026–2032

Tech firms are pouring hundreds of billions into AI chips, massive data centers, and tools to keep up with chatbots like ChatGPT, Gemini, and Claude. The total AI spending could reach trillions of dollars. The money is coming from venture capital, loans, and even unusual deals that are worrying Wall Street investors, according to Bloomberg research.

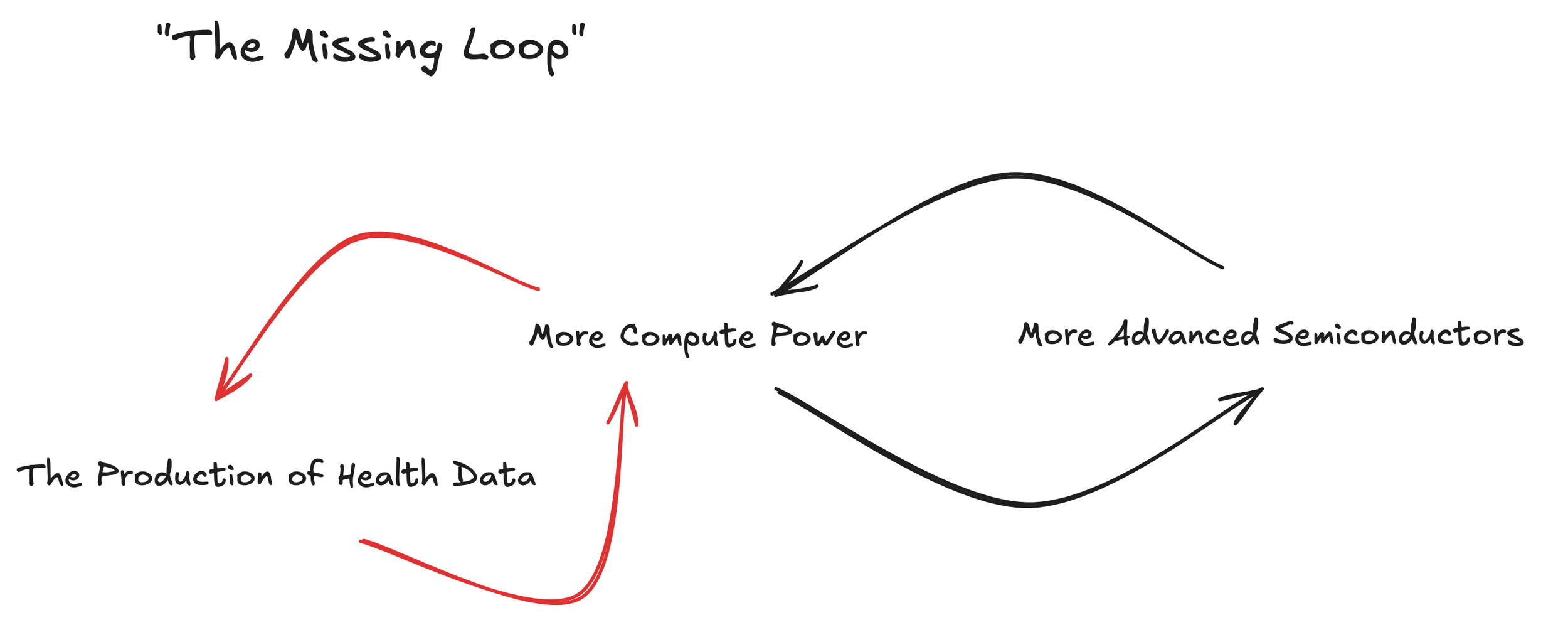

But here’s another reason why a massive trillion-dollar crash is coming: we’ve run out new data to power the compute.

Scaling has been a key factor driving progress in AI. Models are growing in parameters and being trained on increasingly enormous datasets, leading to exponential growth in training compute and dramatic increases in performance, according to research from Epoch AI.

“So far, AI developers have not faced major limits to scaling beyond simply procuring AI chips, which are scarce but rapidly growing in supply. If chips are the only bottleneck, then AI systems are likely to continue growing exponentially in compute and expanding the frontier of capabilities. As such, a key question in forecasting AI progress is whether inputs other than raw compute could become binding constraints.

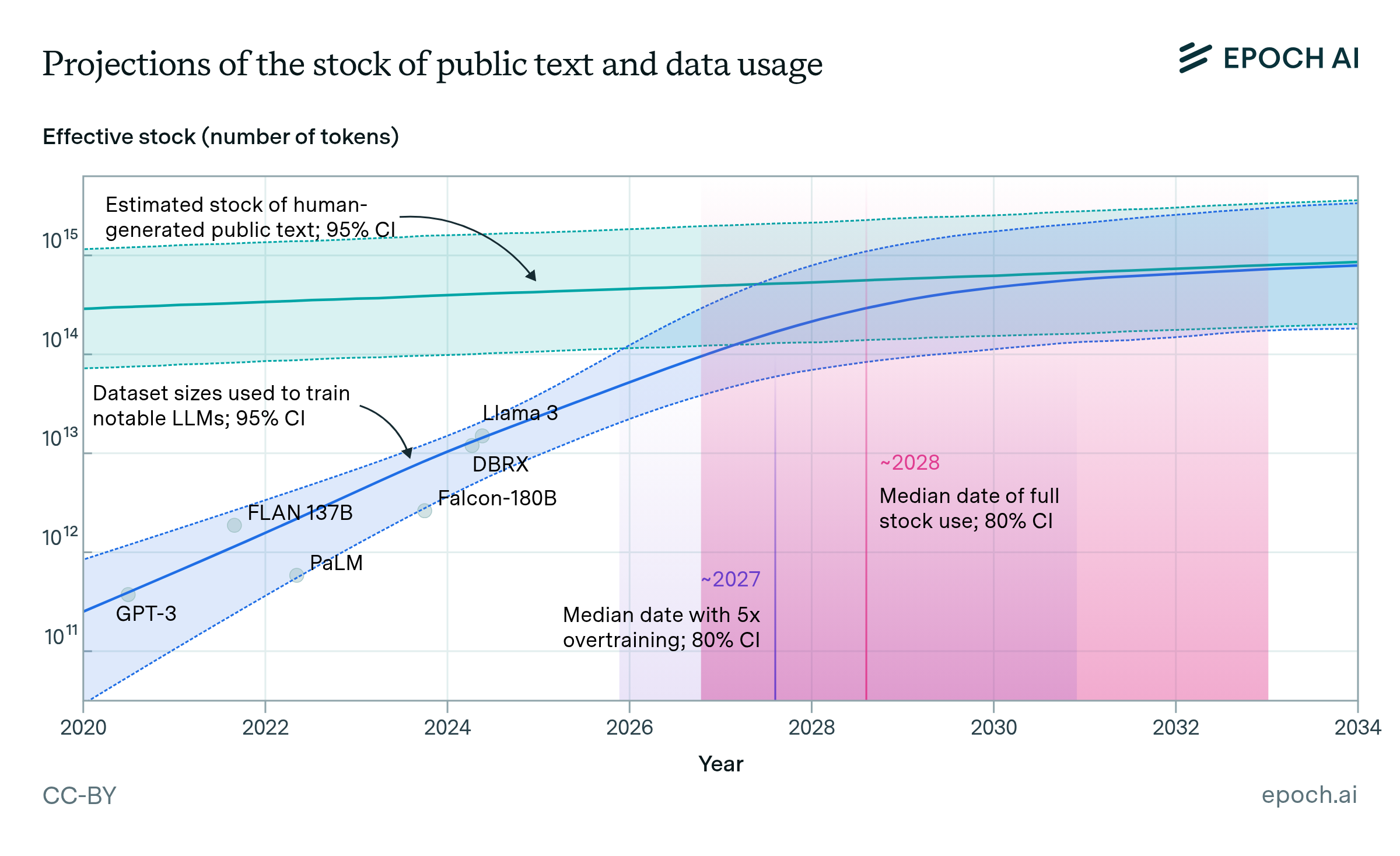

We find that the total effective stock of human-generated public text data is on the order of 300 trillion tokens, with a 90% confidence interval of 100T to 1000T. This estimate includes only data that is sufficiently high-quality to be used for training, and accounts for the possibility of training models for multiple epochs. We report estimates of the stocks of several types of data (above in Figure 1).

But here’s the real problem with $5 trillion chasing infrastructure build (Jeff Bezos last week called this a ‘new horizontal layer’) for compute power: it’s the sound of one hand clapping.

More from Epoch AI’s research:

Given our estimate of the data stock, we then forecast when this data would be fully utilized. We develop two models of dataset growth. One simply extrapolates the historical growth rate in dataset sizes, and the other accounts for our projection of training compute growth and derives the corresponding dataset size (more below). Our overall projection, shown in Figure 2 (below), comes from combining these two models. Our 80% confidence interval is that the data stock will be fully utilized at some point between 2026 and 2032.

Artificial intelligence has become, to teal a line from an old Joan Didion essay, “the ganglia of the fantastic pulsing” of Silicon Valley, and the neurons are now misfiring.

The scale of data-center expansion is even stretching the ability of the U.S. to provide enough electricity, backup generators and other equipment, as it is now measured most effectively in percentages of GDP. The spending may help spread money from AI investment more broadly across the economy. But it also makes it harder for old industries that have to compete for power and equipment with companies flush with the gusher of AI cash.

And the rest of the economy is not only suffering, but also at risk.

“America is now one big bet on AI,” believes Ruchir Sharma, writing in the Financial Times yesterday. “AI better deliver for the US, or its economy and markets will lose the one leg they are now standing on.”

Why AI Needs More Humanity

Human populations will start to decrease globally in a few more decades. Thereafter fewer and fewer humans will be alive to contribute labor — and taxes — to consume what is made. It has been nearly a thousand years since we last saw the total number of humans on this planet decrease year by year. For nearly a millennium we have lived with growing populations, and faster rates of growth. But in the coming decades, for the first time in a thousand years, the number of deaths on the planet each year will exceed the number of births.

However at the same historical moment as this decrease, we are creating millions of AIs and robots and agents, who could potentially not only generate new and old things, but also consume them as well, and to continue to grow the economy in a new and different way. This is an Economic Handoff, from those who are born to those who are made.

Kevin Kelly in his latest Substack, The Handoff to Bots:

The capitalist system we have built around the globe thrives on growth. Progress has been keyed to growth of markets, growth of labor, growth of capital, growth of everything. However in the second half of this century, there will be no growth in humans. So to continue a rise in living standards for those who are born, we will have to devise an economy that does not rely on the growth of humans. We have no idea what that kind of economic system might look like. Most likely it has to redefine growth as a type of maturity, of gaining betterment, instead of just gaining mass. Maybe it entails UBIs (universal basic incomes) and other economic innovations.

I think it is no coincidence that at the historical moment that humans progress themselves to the point of not breeding because it is inconvenient, that they invent a million virtual beings, a billion artificial minds, trillions of robots and a zillion working agents. Think of this as a handoff – a shift from one regime based on the biologically born to another based on the manufactured made. We are in transition from the world of the Born handing off to the world of the Made.

Or something in between.

The pharmaceutical industry is now one of the largest data-producing systems on the planet, a sprawling networked economy in its own right of labs, trials, and patient touchpoints generating digital (i.e., value) exhaust at every step. From molecular simulations to connected inhalers to the nascent direct-to-patent platforms in the works at 94 percent of the drug market in the United States, the pharmaceutical economy runs on information — terabytes becoming petabytes, petabytes becoming exabytes — and yet most of it still lives in silos, unstructured and unlinked.

A single clinical trial can generate multiple petabytes once flows from the medical imaging market ($70 billion a year), genomics testing market ($100 billion a year), and real-world evidence market ($8 billion a year) are layered in. Across the top 20 pharma companies, the total data footprint likely exceeds one exabyte, growing 20–25% a year. But the real story isn’t scale, it’s market interoperability. Pharma has the data to reinvent its own economy, but not yet the architecture to make it work like one.

In Blue Spoon terms, this is the new Magic Quadrant for the pharmaceutical industry: not molecules or marketing, but meaning and 'total system leadership', economic innovation around specialized cognition from data fused into strategy, story, and ecosystem design. The winners won’t be those who collect the most data, but those who cohere it, shaping the characters and chapters and plot lines into narrative intelligence: the connective tissue between science, markets, and human experience.

No Fuel Left for the Pilgrims

Human beings are not computers. The communities they form are not electronic networks. Society does not scale.

What’s missing in the missions and manifestos of the ‘endless ladder myth’ that is the technology industry is any sense of people as individuals, with their own backgrounds and beliefs, personalities and motivations, quirks and biases. “People join together in groups on the basis of shared values not technical protocols,” writes Nicholas Carr in Superbloom, How Technologies of Connection Tear Us Apart.

Oftentimes, the interests or values of one group (say the technology industry, determined to create a big strategic rotation from humans to machines) will be in conflict with those of other groups (say, people).

No Fuel Left for the Pilgrims by Danish rock band D-A-D (formerly Disneyland After Dark before Walt put his foot down) carries a layered, ironic meaning that captures the band’s dark humor and their critique of modern disillusionment. In interviews, the band described the title as a satirical take on Western culture, especially the way people chased money, pleasure, and fame as if they were holy quests. The “pilgrims” here are modern people — consumers, rockers, suburbanites — all looking for meaning, but their tanks are empty because the culture has nothing transcendent left to offer. It’s a joke and a lament at once.

The AI tank is empty.

The human task is to make sure that in the following decades, as our biological numbers start to shrink on this planet, that we can repopulate it with new economic systems, using a sufficient number of synthetic agents, bots, and robots with sufficient intelligence, grit, perseverance, and moral training to self-generate markets in time to keep our living standards rising.

“We are not replacing existing humans with bots, nor are we replacing unborn humans with bots,” believes Kelly. “Rather we are replacing never-to-be-born humans with bots, and the relationship that we have with those synthetic agents will be highly mutual. We build an economy around their needs, and propelled by their labor, and rewarding their work, but all of this is in service of our own definition of progress and human success.”

We better hurry, because another stunning collapse is in the works.

Note: This is the first of a two-part article unpacking ‘The Keystone Advantage’ of the pharmaceutical industry in leading the next cycle of business and economic innovation in the largest and most lucrative market on Earth: the production of cardiometabolic health + the production of reproductive health.

/ jgs

John G. Singer is the executive director of Blue Spoon, the global leader in positioning strategy at a system level. He works with organizations to design new market narratives and exit strategies from collapsing systems.

He is the author of When Burning Man Comes to Washington: A Field Manual for Riding Chaos, which introduces Hardcore Zen, a unique method for leading system-level change. His latest work, The Burning Man Index™, scores 27 institutions on their proximity to narrative collapse — the moment an organization's story stops matching the world it operates in.

To explore a Hardcore Zen whiteboard or arrange a guest lecture, email here.