Here’s a Brick in Yer Face

Routine Large-Scale Psychic Events

From the window of a jet flying at six hundred miles per hour, the blue sky looks completely still. We don’t feel the headlong momentum.

The business of transformation is elusive because it is systemic, invisible and dispersed. It has no center. No clearly defined boundaries. Everything is edge. A big change changes us with such subtle uniformity of pressure that we hardly know we’re being changed. Ours is now the world of routine large-scale psychic events, where an inversion of the expected order happens by the hour, where innovation shock is the operating ethic, humanity floating in a fabulous warp where you take the journey first and then announce your departure.

“I am trying to catch hold of something that is in many ways like one of those gases that are without color, odor, shape or apparent substance, and are undetectable except by way of the effects they produce, the knowledge that we are trapped inside of a huge system, one governed by forces we cannot control and that are essentially invisible,” writes Sven Birkerts in Changing the Subject, where he examines art and attention in the Internet Age.

No one fully understands the machinery, including the people supposedly in charge. Which is one reason why even the best traders struggle to predict sudden jumps in volatility.

Daily share price swings worth hundreds of billions of dollars are becoming commonplace, highlighting the risks to investors — and we are all investors — as the orbit in which Big Tech companies rotate and power the value of $35 trillion in personal wealth and health grows more unpredictable and chaotic. (For more on this, see Bogus Rules: Sam’s Problem is Now My Problem, published last month by Blue Spoon.)

Individual stocks have gained or lost more than $100 billion in market value in a single day 119 times so far this year, the highest annual total on record, per reporting by the Financial Times last week.

“The rise of 12-figure stock swings partly reflects the huge size of companies such as Nvidia, Microsoft and Apple, which are all worth more than $3 trillion each and account for the bulk of the huge moves. But even accounting for the stock market’s growth, the size of this year’s moves has been extraordinary.

Bank of America analysis shows that 2025 has already punched through 2024’s record number of what it calls “fragility events” in Big Tech stocks, when share prices move well outside their usual range.”

For anyone hoping to beat the market — including the quant shops and other hedge funds that promise returns whatever the weather — there are few more pressing questions than whether a crash is imminent, writes The Economist in Why Wall Street Won’t See The Next Crash Coming, published this week. “The Nirvana of macro trading is forecasting these turning points,” says James White of Elm Wealth, but a former trader at a rival hedge fund added, “I know of no other firm than Bridgewater that has been successful with these macro models.”

Mathematical gymnastics can do a pretty good job of pinpointing scenarios in which such these shocks might have an outsize impact on markets - its ‘system effects’ — but math isn’t strategy. And these macro models aren’t good at capturing emergence, the Invisible Hand, the fuzzy sweep of human-economic-technologcal interaction that produces the wealth and health of nations. And even the best of them cannot predict the kind of “pure shock” — like a pandemic or a run on a bank or the President of the United States blaming Tylenol for autism — that sparks a strategic collapse..

Not Starbucks. Not WPP. Not Novo Nordisk. Not Walgreens. Not McKinsey. Not Kenvue. Not the Democratic Party.

The snag is that achieving Nirvana is almost impossible to see in advance.

During a briefing by academics at the London School of Economics as the 2008 financial crisis was reaching its climax, Queen Elizabeth II, whose personal fortune was estimated to have fallen by as much as 25 million pounds, asked the question that was on the minds of many of her subjects: “Why did nobody see it coming?”

The response by her advisors at the time was blunt:

Economics could not give useful service to explain the crisis because current economic theory has established that it cannot predict such crises. As John Kay, one of Britain’s leading economists wrote shortly afterwards, “Faced with such a response, a wise sovereign will seek counsel elsewhere.”

Controlled environments encourage complacency, making it hard to cope when controls break down, as they sooner or later must. More to the point: If you can model it, you’re wrong. The secret for having a model to deal with the planet of inexperience is to assume you know nothing from the start. In a world of radical uncertainty, narratives unfold systemically, in concert with the dynamic.

Renegade Narratives

The story has become many people’s primary way of understanding the world. As the literary theorist Peter Brooks argues in his 2022 book Seduced by Story, “Narrative seems to have become accepted as the only form of knowledge and speech that regulates human affairs.” In the process, Brooks observes, story has eclipsed rational argument as the dominant purveyor of social, political, and historical truths.

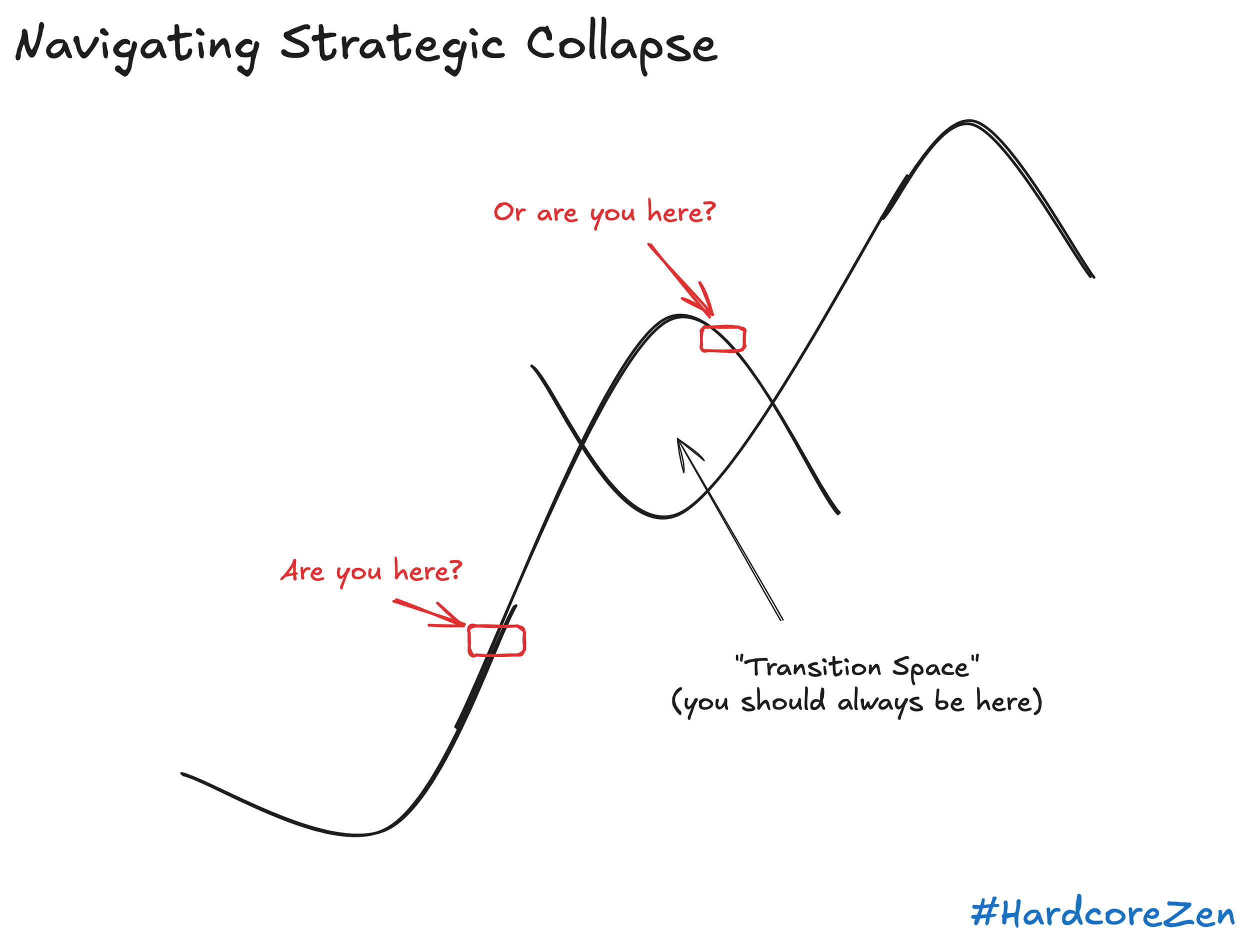

Donald Trump didn’t wreck the old order so much as he understands how to exploit the wreckage already there. He is able to navigate the transition space of multiple shifting paradigms because he has better system vision. He ‘reads the room’ better, which means he is able to see reality better: that the elephant in the room is the room itself.

From a New Age of Competition perspective, Trump has the better renegade narrative.

The same is true of Zohran Mamdani, who is all but certain to become the next mayor of New York City, a socialist now leading what has long been seen as the beating heart and global emblem of capitalism. Mamdani’s win, like Trump’s, will be a profound symbolic inversion, another large-scale psychic event: the global capital of capitalism ruled by its ideological opposite, signaling not just political change, but a deeper reckoning with the narratives of wealth, power, and inequality that the city itself has come to embody.

There’s a clarity about Mamdani’s story-telling and story-selling, an edge, that stands in sharp contrast to most Democratic politicians, noted Astead Herndon, editorial director at Vox who wrote a recent New York Times magazine cover story titled The Improbable, Audacious and (So Far) Unstoppable Rise of Zohran Mamdani. “He works from the premise of his beliefs,” Herndon said on CNN. “A lot of Democrats have mastered this triangulation dance, where it feels like sometimes, they’re trying to say nothing.” It’s a chronic condition. The same could be said about executive content and communications pretty much across the board.

From Trump is Full of Narrative Surprise, and You Should Be Too, published on Fresh Paint, the Blue Spoon Consulting blog:

Between the stimulus barrage of modern life and the psychic assault on our conventional cognitive patterns, the daily hard break from The Rules We Used to Play By, comes this nagging sensation of weightlessness. We are floating with radical uncertainty. Our ‘theory of control’ has collapsed.

An entire context of mattering is in question. Without a strong sense of self or direction, we seem unable to find ourselves in the big picture, much less paint a new one from which to lead the next iteration. We are being conditioned to accept the laws of the new system.

There’s a balance, then, between integrative and disintegrative processes — an edge of chaos — where adaptation, especially self-organization, tends to occur. New political worlds work similarly.

In a crisis, when the engineering mindset no longer serves, what matters is whether the story makes sense. The role of the model or the technology is not to throw out a number or automate another workflow, but to construct and then guide a different, bigger, collective innovation narrative.

“I think my life could really improve if he wins,” enthused one young woman, quoted in an ABC News story about Mamdani. Another respondent compared him in one respect to Donald Trump: “There’s no flip-flopping.”

Another approvingly described Mamdani as “badass”.

No Formula for the Future

As much as you get the sense from Sam et. al. that he would prefer otherwise, we are not robots with fixed, mechanistic responses to inputs. We face a changing world that, in turn, changes the context with which we view the world, and that changes us. The critical implication is that we cannot plug numbers into a model and solve for the future. We cannot know where we will end up until we lead the journey with a renegade story, a brick in yer face.

Something both Trump and Mamdani know full well.

/ jgs

John G. Singer is Executive Director of Blue Spoon, the global leader in positioning strategy at a system level. Blue Spoon specializes in constructing new industry narratives.