How to Solve “Medication Adherence” in One Slide

Legacy Narratives Overpower

"Maybe the new CEO comes up with something even more creative," Jeff Jonas, portfolio manager at Gabelli Funds, told Reuters last week after Walgreens Boots Alliance recorded a $6 billion hit to its business because of a bad bet [so far] on VillageMD.

New CEO Tim Wentworth -- he replaced Rosalind Brewer, who stepped down after three years, last October -- said Walgreens was now "reviewing every business through a longer-term lens" to focus on “strategic fit to a challenging retail environment.”

This fit-finding includes cutting costs -- VillageMD is exiting Nevada, Illinois, Indiana, Florida and most of Rhode Island -- and dealing with the earnings/revenue collapse from essentially zero demand for Covid products and services (the same challenge Pfizer, Moderna and BioNTech are navigating through). It also is focused on increasing shareholder value — Walgreens Boots Alliance stock is down 64 percent over the last five years.

Wentworth used to lead Express Scripts, so he understands the 'pharmacy operating system' well. In an interview last year with the Wall Street Journal:

“The PBMs have forced the retailers to continually up their games on service and value, and my belief is that there is a great deal more we can do to continue to be a partner of choice,” he said at the time. “I understand intimately the challenges that payers face, having been one of the largest providers to payers, and have aligned entire organizations to be responsive to and innovative for payers in ways that created value for them.”

But operations isn’t strategy. And this intimate knowledge of PBM operations may turn into a Big Problem to the whole new value creation agenda for Walgreens.

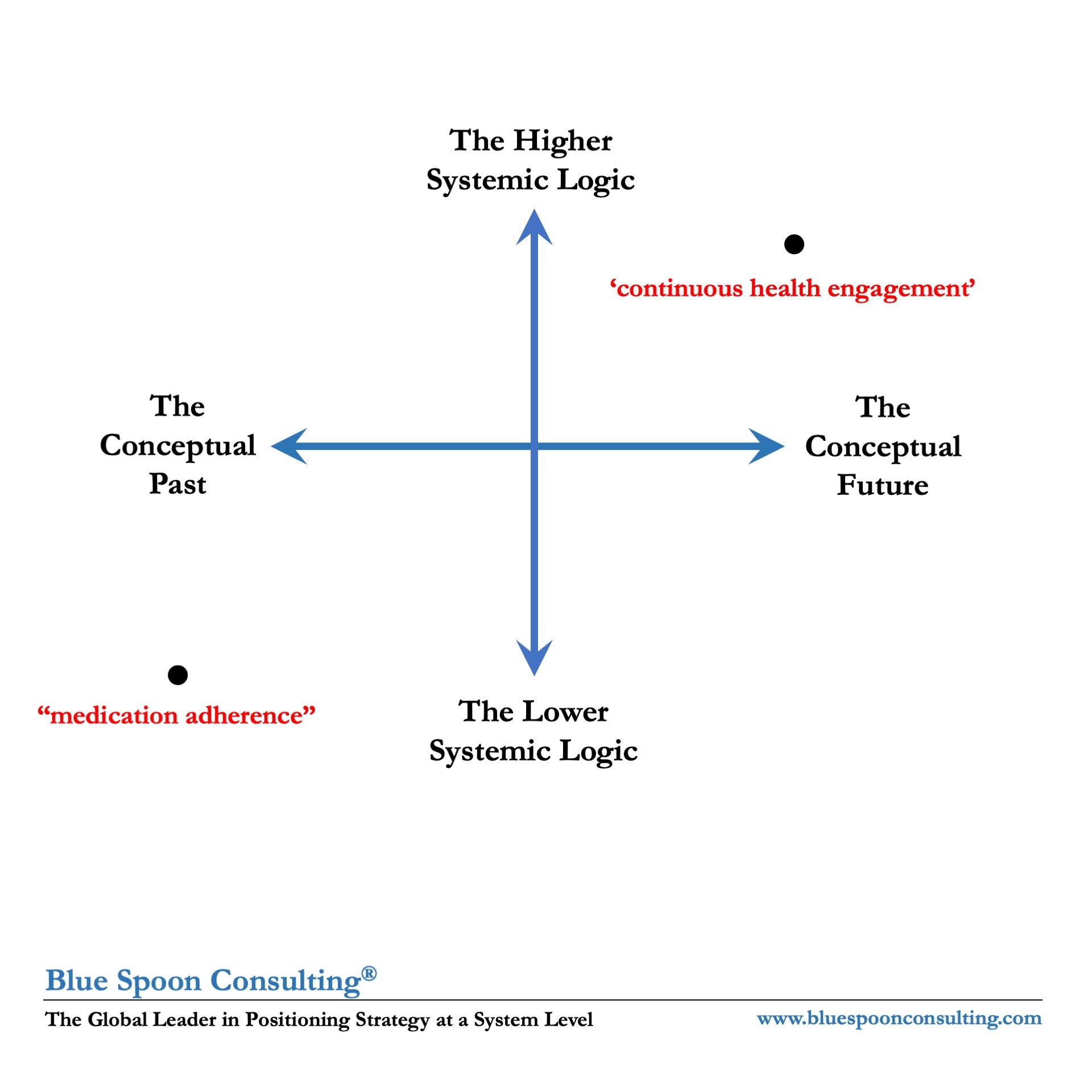

For the most part, we’re either asking the wrong questions, or our questions are based on the wrong framework.

The real "payer" for Walgreens to partner with is the self-funded employer, not the UnitedHealth Group’s and Cigna’s of the conceptual past. The real competitor to Walgreens isn't CVS Health, but the American Medical Association, blocking pharmacists from getting too deeply involved in primary care, as well as Epic, whose EHR systems define the rules by which medicine is practiced. In quantum terms, these entities are the center-of-gravity around which everything and everyone else rotates, including entire industries, companies and consumers-as-shoppers-as-patients-as-employees.

No one ever cuts their way to growth.

The skill in short supply is original story-telling, new words to enable a fresh creative response to what seems to be rampant commoditization and commercial withering across the board, save for the small handful.

“Strategic fit” to a different operating environment happens through a completely different set of concepts. It’s not about making the “horseless carriage” better with The Digital, but inventing the “automobile” as an organizing idea, a large-language model around which markets cohere and are born.

Defining the future — the future of work, the future of technology, the future of government, the future of business and society, the future of healthcare, the future of competition — happens using a new grammar of strategy.

And in the largest and most lucrative market on Earth, this means positioning ‘continuous health engagement' at the center of a better operating system.

Until that happens, the probability for commercial success for a business locked in the conceptual past is low. Ditto for its business mangers.